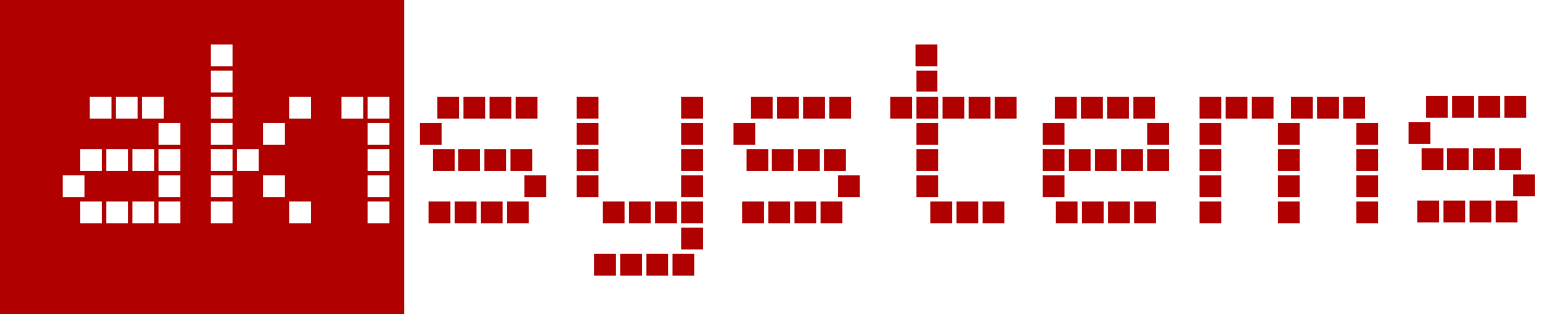

Imagine going to the movies with family or friends. You purchase tickets with your payment card, and almost immediately receive a notification on your phone:

You can quickly check if you were charged the correct amount — or if you recognize the transaction in the first place.

But there is more. You click on the notification and see the following:

The top half of the screen is self-explanatory — you can tap on it for more detailed transaction information — but it is the bottom half that draws your attention.

You notice how specific the ad is. A restaurant is offering you a discount, but only at your current location and only for the next day or so. Since people often go out to eat after seeing a movie, chances are that the offer will be both timely and relevant to you.

As another example, suppose that you repeatedly visit a hamburger joint:

Since you're obviously a fan of hamburgers, you are presented with an offer from a competing burger chain. The offer is unquestionably relevant to your eating habits! However, it is not timely — you might take advantage of it at a future date, but probably not right now.

Fortunately, the mobile app allows you to save offers for later use. The list of saved offers may be viewed

by tapping  at the bottom of the screen. You may also

browse your offers using

at the bottom of the screen. You may also

browse your offers using  and

and  ,

or search for a particular offer with

,

or search for a particular offer with  . Use

. Use  to permanently delete an offer from your mobile device.

to permanently delete an offer from your mobile device.

As we've seen, the purchases you make — and when and where you make them — are a great indicator of your actual preferences and and tastes, and can be used to present you with relevant and engaging offers. In order to achieve this, we must somehow combine the world of mobile banking with that of online advertising.

This is a bit tricky, since your bank cannot readily disclose your personal information — name, account number, address, age, etc. — to anyone. Besides, you probably don't wish to share your personal data anyway. But how can advertisers present you with great offers if they do not know anything about you?

The solution is quite simple, and builds upon a mechanism already used by online advertisers — the browser cookie.

While browsing the web, you have almost certainly encountered websites making use of cookies. (Well-designed websites will even inform you of this.) A cookie is essentially a very large, randomly generated string of letters that is placed in your browser's memory. Once it is placed there, the cookie can then be read back by other websites (or web pages) that you visit. In essence, then, the cookie is used to track your browsing behavior.

Advertisers use cookies to determine which pages you visited (and hence which ads you saw), which ads you clicked on, and which ads led to a purchase of a good or service. All of this information is then used in an attempt to present you with more relevant ads in the future.

At this point, it is important to note that cookies do not reveal your true identity. What they do reveal is merely which web pages were loaded by a web browser running on some device somewhere. In addition, cookies can usually be deleted, forcing all tracking operations to "start over."

The mobile application described above may be thought of as generating a series of web pages. Each such page contains transaction information as well as an advertisement, much like an ordinary Internet website might.

We now generate a cookie and associate it with your cardmember account. Just like before, the cookie will be a long, randomly generated string of letters and numbers. The cookie will be used to track your spending patterns, while keeping your real identity a secret.

The scheme works as follows. Whenever you make a purchase, the advertising network receives the cookie we generated, as well as basic transaction information such as the amount spent, the name of the merchant, etc. We will never send any data that would reveal your identity.

The advertising network uses the cookie received to retrieve past activity associated with it. (Remember, they still do not know who you are.) Past activity includes previous transaction information as well as how you interacted with offers previously presented to you inside the mobile app.

All of this information is then used to provide you with an offer that is hopefully relevant and engaging: a coupon from a competing burger chain; a seat upgrade from a competing airline; an offer from a nearby restaurant. All of this is possible because your actual (anonymized) purchase decisions are known.

And that's it. The mobile app becomes a revenue-generating ad publisher. Your issuing bank receives a cut of this revenue, and may even share some if it with you.

Patent(s) pending. Copyright © 2016-2019 by Akisystems LLC. All rights reserved.

All product names, logos, and brands are property of their respective owners. All company, product and service names used in this website are for illustrative purposes only. Use of these names, logos, and brands does not imply endorsement.